By Dr. Arvind Kumar, President, India Water Foundation

India has been the fourth or fifth largest energy consumer in the world, after the United States, China, Japan and Russia. Despite a slowing #globaleconomy, India’s energy demand continues to rise. While India’s domestic #energy resource base is substantial, the country relies on imports for a considerable amount of its energy use.

According to the #InternationalEnergyAgency (#IEA), hydrocarbons account for the majority of India’s energy use. Together, coal and oil represent about two-thirds of total #energyuse. #Naturalgas now accounts for a seven percent share, which is expected to grow with the discovery of new gas deposits.

Combustible renewables and waste constitute about one forth of Indian energy use. This share includes traditional biomass sources such as firewood and dengue, which are used by more than 800 million Indian households for cooking. Other renewables such as wind, geothermal, solar, and hydroelectricity represent a 2 percent share of the Indian fuel mix. Nuclear holds a one percent share.

Oil

According to #Oil & #Gas Journal (OGJ), India had approximately 5.7 billion barrels of proven oil reserves as of January 2012, the second-largest amount in the Asia-Pacific region after China. India’s #crudeoil reserves tend to be light and sweet. India produced roughly 950 thousand barrels per day (bbl/d) of total liquids in 2010, of which 750 bbl/d was crude oil. The country consumed 3.2 million barrels per day (bbl/d) in 2010.

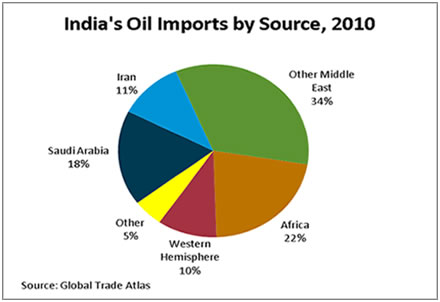

The combination of rising oil consumption and relatively flat production has left India increasingly dependent on imports to meet its #petroleumdemand. In 2010, India was the world’s fifth largest net importer of oil, importing more than 2.2 million bbl/d, or about 70 percent of consumption. A majority of India’s crude oil imports come from the #MiddleEast, with #SaudiArabia and Iran supplying the largest shares. Iranian oil’s share of Indian imports has decreased in recent years, largely due to issues with processing payments.

Sector Organization

Though the government has taken steps in recent years to deregulate the hydrocarbons industry and encourage greater foreign  involvement, state-owned enterprises predominate in India’s oil sector. The largest player is state-owned Oil and Natural Gas Corporation (#ONGC), which accounted for about three-quarters of India’s oil production in 2009-2010. The role of private companies in Indian oil production is increasing. The largest private actor in the oil sector is Reliance industries, India’s largest company.

involvement, state-owned enterprises predominate in India’s oil sector. The largest player is state-owned Oil and Natural Gas Corporation (#ONGC), which accounted for about three-quarters of India’s oil production in 2009-2010. The role of private companies in Indian oil production is increasing. The largest private actor in the oil sector is Reliance industries, India’s largest company.

As a net importer of oil, the Indian government has policies aimed at increasing domestic exploration and production (E&P) activities. In an effort to attract oil majors with deepwater drilling experience and other technical expertise, the #MinistryofPetroleumandNaturalGas created the New Exploration License Policy (#NELP) in 2000, which for the first time permits foreign companies to hold 100 percent equity ownership in oil and natural gas projects. Despite this, international oil and gas companies currently operate a small number of fields.

India’s downstream sector is also dominated by state-owned entities. The #IndianOilCorporation (IOC) is the largest state-owned company in the downstream sector, operating eight of India’s 21 refineries and controlling about three-quarters of the domestic oil pipeline transportation network. Government-run Oil marketing companies (OMC’s) play a major role in the distribution of fuel. Reliance Industries opened India’s first privately-owned refinery in 1999, and has gained a considerable market share in India’s oil sector.

Exploration and Production

Most of India’s crude oil reserves are located offshore, in the west of the country, and onshore in the northeast. Substantial reserves also exist in the Bay of Bengal and in Rajasthan state. India’s largest oil field is the offshore Mumbai High field, located north-west of Mumbai and operated by ONGC. Block D6 in the #KrishnaGodavaribasin, a major gas play operated by RelianceIndustries, began oil production in September 2008.

The ninth round of auctions under the #NELP framework concluded in March 2011, attracting 74 bid for 33 of 34 blocks. Most of the interest in these assets came from Indian companies, which collaborated to achieve an advantageous position in the bidding. International oil companies only participated to a limited extent due to uncertainty about reserve levels. Despite these efforts to increase investment, India’s limited resource base will cause production to remain relatively flat. In the #InternationalEnergyOutlook (IEO2011), EIA projects that #Indianoil production will grow at an average annual rate of less than one percent through 2035.

In recent years, Indian national oil companies have increasingly looked to acquire equity stakes in E&P projects overseas. The most active company abroad is #ONGCVidesh Ltd. (OVL), the overseas investment arm of ONGC. OVL conducts oil and natural gas operations in 15 countries. The company produces oil in Russia (Sakhalin Island), Sudan, Vietnam, Columbia, and Syria. In October 2011 the company announced that it aspires to expand its total production from current levels of about 150 thousand bbl/d to 560 thousand bbl/d by March 2014.

Strategic Petroleum Reserve

India is constructing a #strategicpetroleumreserve (#SPR) to shield the import-dependent country from potential supply disruptions. Three storage facilities, located near refining centers #Visakhapatnam, #Mangalore, and Padur, are scheduled to be completed by the end of 2012. They will hold close to 40 million bbl of oil, which represents about ten days of supply on a refinery-throughput basis.

Natural Gas

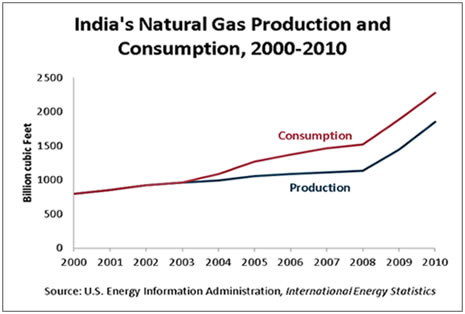

Despite major new natural gas discoveries in recent years, India continues to plan on gas imports to meet its future needs. According to Oil and Gas Journal, India had approximately 38 trillion cubic feet (Tcf) of proven natural gas reserves as of January 2011. EIA estimates that India produced approximately 1.8 Tcf of natural gas in 2010, a 63 percent increase over 2008 production levels. The bulk of India’s natural gas production comes from the western offshore regions, especially the Mumbai High complex, though fields in the Krishna-Godavari (KG) are increasingly important.

In 2010, India consumed roughly 2.3 Tcf of natural gas, more than 750 billion cubic feet (Bcf) more than in 2008, according to EIA estimates. Natural gas demand is expected to grow considerably, largely driven by demand in the power sector. The power and fertilizer sectors account for nearly three-quarters of natural gas consumption in India. Natural gas is expected to be an increasingly important component of energy consumption as the country pursues energy resource diversification and overall energy security.

Despite the steady increase in India’s natural gas production, demand has outstripped supply and the country has been a net importer of natural gas since 2004. India’s net imports reached an estimated 429 billion cubic feet (Bcf) in 2010.

Sector Organization

State-owned companies play a predominant role in India’s gas sector, although their share of production is smaller than in the oil  sector. ONGC accounted for about half of India’s natural gas production in 2009-2010. Reliance Industries will also have a greater role in the natural gas sector in the coming years, as a result of a large natural gas find in 2002 in the KG basin. In June 2011, the Indian government approved a $7.2 billion joint venture agreement between Reliance and BP that will focus on expanding offshore development.

sector. ONGC accounted for about half of India’s natural gas production in 2009-2010. Reliance Industries will also have a greater role in the natural gas sector in the coming years, as a result of a large natural gas find in 2002 in the KG basin. In June 2011, the Indian government approved a $7.2 billion joint venture agreement between Reliance and BP that will focus on expanding offshore development.

Natural gas prices in India are regulated by the government. Administered Pricing Mechanism (APM) natural gas – gas produced from fields handed to #ONGC and #OIL by the Indian government – more than doubled in price in May 2010; from $1.8/million (MM) Btu to $4.2/MMbtu, although some customers still receive subsidies. Prices for privately produced gas, which are indexed to the price of oil, are slightly higher.

The #GasAuthorityofIndiaLtd. (#GAIL) holds an effective monopoly on natural gas transmission and distribution activities. Although the transmission sector was opened to foreign investment in 2006, 80 percent of natural gas consumed in India was transported through GAIL’s 4,100-mile trunk pipeline network. The company expects to double the size of this network by 2014. Reliance Industries is also investing heavily in the transmission sector to move its KG-basin gas to market.

Exploration and Production

Until 2008, the majority of #India’s natural gas production came from the Mumbai High complex in the northwest part of the country. Recent discoveries in the Bay of Bengal have shifted the center of gravity of Indian natural gas production.

In April 2009, production from #RelianceIndustries’ Dhirubhai 1 and Dhirubhai 3 gas fields in the D6 block of the KG Basin has led to a massive expansion in domestic supply. The block holds estimated reserves of 11.5 Tcf. Of the nearly 1.4 Bcf/d of initial production, nearly half went to gas based power plants, the rest to fertilizer, LPG plants, and city gas distribution entities. After reaching a production peak of 2.8 Bcf/d in December 2009, Reliance decided in July 2010 to cap production of KG-D6 at 2.1 Bcf/d pending resolution of infrastructure and field maintenance problems. Industry analysts expect the BP-Reliance partnership to address these issues.

In addition to these new offshore finds, India plans to expand the development of unconventional gas resources. The country already produces some coal bed methane and seeks to expand these volumes soon. In addition, an EIA-sponsored study on world shale gas resources reports that India possesses 63 Tcf of technically recoverable shale gas resources. The country has yet to hold a licensing round for its shale gas blocks.

Natural Gas Imports

India’s natural gas import demand is expected to increase in the coming years. To help meet this growing demand, a number of import schemes including both #LNG and pipeline projects have either been implemented or considered. The Iran-Pakistan-India (IPI) Pipeline has been under discussion since 1994. The plan calls for a roughly 1,700-mile, 5.4-Bcf/d pipeline to run from the South Pars fields in Iran to the Indian state of Gujarat. A variety of economic, political, and security issues have delayed a project agreement.

The governments of India and Myanmar signed a natural gas supply deal in 2006, but disagreement arose over whether the pipeline should go through Bangladesh. In March 2009, Myanmar signed a natural gas supply deal with China sourced from a field invested in by GAIL and ONGC, putting any India-Myanmar pipeline deal in question.

Liquefied Natural Gas

India began importing liquefied natural gas (LNG) in 2004. In 2009, India imported 434 Bcf of #LNG, nearly 65 percent of it from Qatar, making it the sixth largest importer of LNG in the world.

Currently, India has two operational LNG import terminals, Dahej and Hazira. India received its first LNG shipments in January 2004 with the start-up of the Dahej terminal in Gujarat state. Petronet LNG, a consortium of state-owned Indian companies and international investors, owns and operates the Dahej LNG facility with a capacity of 6.5 million tons per year (mtpa) (975 Bcf/y). India’s second terminal, Hazira LNG, started operations in April 2005, and is owned by a joint venture of Shell and Total. The facility has a #capacity of 3.6 mtpa (488 Bcf/y). New terminals at Kochi and Dabhol are scheduled to come online in 2012.

Demand for LNG will only expand to the extent that domestic production plans fall short of stated goals. Further, plentiful and cheap #domesticgas that sells at a discount to imported LNG makes the international spot market a marginal option and complicates negotiations for long-term supply contracts.

The #Gulfregioncontinues to be the major source of India’s energy supply. Undoubtedly, the Gulf region is politico-strategically a sensitive region and any untoward #development can adversely impact on India’s energy supplies, India’s dependence on Gulf is likely to continue in near future as well. The Indians working in #Gulfcountries, as shown in Table below, constitute a decisive factor in India’s relations with these countries.

Table-Indian Diaspora in Gulf and Neighbouring Countries

| Country | Population | PIOs | NRIs | Stateless | % of Population |

| Bahrain | 643,000 | Nil | 130,000 | — | 20.22 |

| Iraq | 23,000,000 | 50 | 60 | — | Insignificant |

| Kuwait | 2,254,000 | 1,000 | 2,94000 | — | 12.80 |

| Libya | 5,800,000 | 400 | 12,000 | — | Insignificant |

| Oman | 2,300,000 | 1000 | 311,000 | — | 13.52 |

| Qatar | 525,000 | 1000 | 130,000 | — | 23.81 |

| Saudi Arabia | 21,500,000 | Nil | 1,500,000 | — | 6.90 |

| UAE | 2,900,000 | 50,000 | 900,000 | — | 30 |

| Yemen | 7,676,000 | 100,000 | 9000 | — | 0.62 |

Conclusion

Keeping in view the strategic and economic importance of the Gulf region, India should evilve a cooperative and friendly policy towards Gulf region for having sustainable energy supplies as well as ensuring the security and well-being of the Indians working in these countries. There is also a need for enhanced economic interaction between India and the #Gulfcountries through increased trade, #FTA arrangements and joint ventures in third countries.