Ms. Rupa Devi Singh, currently the MD & CEO of Power Exchange India Ltd., has played commendable role in the realm of power exchange in India. She has been associated with the concept of a Power exchange in India from its inception in 2004 when she led an assignment for detailing the feasibility of setting up a day ahead power exchange in the country. Having over a decade’s experience and expertise in nfrastructure and structured finance, she has participated in a number of path breaking initiatives in a broad range of Infrastructure sectors. Prior to this she was Director (Power Practice) with CRISIL Infrastructure Advisory. While at CRISIL, she worked closely with the Government and Government-owned entities as well as multilateral organizations in the areas of shaping public policy and has led a number of path breaking initiatives in the Indian Power Sector. She takes a keen interest in policy advocacy and is a frequent speaker at Infrastructure events in India and abroad. Under her dynamic leadership and inspiring guidance, the Power Exchange India Ltd. has emerged as a force to reckon with.

Power Exchange India Limited (PXIL) is India’s first institutionally promoted Power Exchange that provides innovative and credible solutions to transform the Indian Power Markets. A deep understanding of the local markets is matched by PXIL’s non-partisan, unbiased and often fearless functioning, at times even in the face of uncomfortable conclusions.

Company’s core values are – integrity, excellence, commitment and continued innovation. These are the bedrock on which the edifice of PXIL stands.

PXIL’s unique combination of local insights and global perspectives helps its stakeholders to make better informed business and investment decisions, improves the efficiency of the power markets, and helps shape policies and projects.

Vision

The Company’s vision is to create a significant difference and retain the benchmark of unquestionable integrity and excellence for its stakeholders by continually innovating and offering credible solutions to transform the Indian Power Markets.

Mission

The Company’s Mission is:

- To constantly demonstrate our core values – Integrity, Excellence, Commitment and Continued Innovation – and to remain non-partisan, unbiased and fearless in our functioning, even in the face of uncomfortable conclusions.

- To nurture our talented workforce and continually strengthen our local insights and global perspectives so as to bring about a paradigm shift in the functioning of our power markets.

- To aid our stakeholders to make better informed business and investment decisions, improve the efficiency of the power markets, and help shape policies and projects.

Core Values

Integrity

Our people demonstrate the highest levels of honesty, transparency and ethics to achieve undisputed credibility from our internal as well as external stakeholders. We are resolute in adopting and adhering to the best professional practices, so as to evolve into the definitive benchmark of integrity in the Indian power markets.

Excellence

Our zealous quest for excellence and thought leadership enables us to constantly scale new heights of accomplishments without compromising in any way on our core values.

Commitment

It is our unwavering commitment to create maximum value for all our stakeholders through the highest standards of integrity and best professional practices. We are committed to continuously engaging our stakeholders in our completely open-minded thought leadership process such as to significantly change the way the power markets function.

Continued Innovation

Innovation is continuously reflected in every action, activity and aspect of the organization. Such innovation, while aligned to our core values, is for the purpose of enhancing overall stakeholder value in line with the requirements of the marketplace.

Promoters

National Stock Exchange

- Incorporated in 1993 and commenced business in June 1994.

- Became ‘Largest’ Stock exchange in India in October 1995.

- Current Market share – 70% in equity trading and 98%; in F&O trading

- 4th largest exchange in the World in terms of no. of trades

National Commodity & Derivatives Exchange

- NCDEX is the only commodity exchange fully owned by Institutions.

- Promoted by reputed Institutions like LIC, Canara Bank, NABARD, CRISIL, Goldman Sachs, etc

Equity Partners

Power Finance Corporation Ltd:

Power Finance Corporation (PFC) is one of the Nav-Ratna PSUs of Govt. of India. Dedicated to Power Sector financing and committed to the integrated development of the power and associated sectors, PFC has also taken a Professional Clearing Membership (PCM) of PXIL to provide funding supports to entities buying and selling power on the exchange.

Gujarat Urja Vikas Nigam Ltd:

The holding company for power utilities of Gujarat, GUVNL represents the progressive face of Vibrant Gujarat and is engaged in the business of bulk purchase and sale of electricity, supervision, co-ordination and facilitation of the activities of its six subsidiary companies viz. the generation, transmission and distribution companies.

WBSEDCL

It is responsible for distributing power in the State of West Bengal at 33KV level and below and has consumer strength of over 68 Lakhs. WBSEDCL received the “Power India 2008 Excellence Award” for undertaking Power Sector Reform Initiatives. Earlier, under the provisions of West Bengal Power Reform Scheme, 2007, West Bengal State Electricity Board was restructured and split into two companies namely West Bengal State Electricity Transmission Company Limited (WBSETCL) and West Bengal State Electricity Distribution Company Limited (WBSEDCL).

MP Power Trading Company Ltd

MP Tradeco inherited the rights and obligations of the erstwhile MPSEB and is incharge of bulk purchase of electricity from the generating companies and bulk supply of electricity on short, medium and long term basis to the three Discoms in the State of Madhya Pradesh.

Supportive Policy and Regulatory Framework for Power Exchange

- 2003 June:

Enactment of Electricity Act ’03 which ushered in development of an ‘organized’ electricity market. - 2005 February:

Promulgation of National Electricity Policy by Ministry of Power - 2006 July:

CERC issued ‘Staff Paper on Developing a Common Platform for Electricity Trading’, whereby, it recommended a spot (day-ahead) market for electricity trading. - 2007 February:

CERC issued ‘Guidelines for Setting Up Power Exchanges’ - 2008 January:

CERC finalized new ‘Open Access Regulations for Inter-State Transmission’, which includes guidelines for Power Exchange based transactions (Collective Transactions) - 2008 June:

Guidelines for Scheduling of transactions on Exchanges - 21st October 2008:

Finalization of operating instructions in a multi-exchange scenario - 22nd October 2008:

Start of PXIL’s operations!! - 20th January 2010:

CERC Notifies “Power Market Regulation 2010”

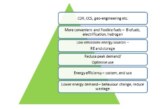

Demand Management Framework

- Utilities have a Base load which they have to cater to at any point in time.

- Variable load is the fluctuation in demand based on the time-of-day or from season-to-season.

- Management of these loads is usually done as follows:

- Base load is met by long term PPAs

- Seasonal Variable loads through Short Term arrangements such as Banking, Bilateral trading

- Daily Variable load through real time balancing under UI mechanism or through Power Exchanges

- A Power Exchange is a fair and transparent platform for entities to manage their electricity demand and supply.

Benefits provided by PXIL

PXIL helps in:

- Convenient Sale and Purchase:

- Fully-integrated computerized platform and a user friendly interface allows buying and selling on click-of-the-mouse.

- No separate arrangement for corridor required as the same is taken care of by PXIL.

- PXIL is counter-party for all trades – removes credit risks from the system

- Provides robust Clearing & Settlement systems

- Better Price Discovery through anonymous auction, as large number of suppliers and buyers interact

- Reference price for all market participants. Helps in instantaneous price dissemination.

- Rigorous financial standards and surveillance procedures ensure safe, orderly, fair market.

- Shall lead to higher Availability and capacity addition leading to better prices. All this will augment short term power market.

PXIL Trading Application Features

- Application accessible through internet

- High security architecture

- Low initial Costs Normal Orders

- Application also accessible through Leased Lines

- Application is capable of splitting ‘N’ no. of markets

- All buy and sell bids would be aggregated to form demand and supply curves through which the Market Clearing Price (MCP) would be determined.

- In case of congestion MCPs would be obtained for split markets.

- No. of markets as per NLDC directions.

- Application is enabled for trading in 15 min time blocks

- Allows management of load peaks and troughs easily.

- In line with time blocks for long term, short term and UI.

- Online calculations of margins